Navigating changes in Federal Home Loan Banks can be crucial for home buyers in the Chicago North Shore area.

Understanding how these changes impact mortgage rates and lending options is essential for making informed decisions. Stay ahead of the game and ensure you’re getting the best mortgage rates in Chicago’s North Shore by staying informed about the latest developments in Federal Home Loan Banks.

Hey there, North Shore Chicago homebuyers! If you’re keeping an eye on the real estate scene, especially with those low mortgage rates, you might have heard a buzz about some changes in the Federal Home Loan Banks (FHLB). Now, I know “banks” might not sound like the most thrilling topic, but bear with me – there’s some interesting stuff happening that could have an impact on the local housing market.

So, here’s the scoop: A recent report from the Federal Housing Finance Agency (FHFA) is shaking things up in the world of FHLB. The report suggests that these banks are about to take on more responsibility for affordable housing goals. What does this mean for you, the North Shore Chicago homebuyer, and how can you make the most of these changes? Let’s break it down in a casual and friendly chat.

Low Mortgage Rates: The Silver Lining for North Shore Chicago Homebuyers

Before we dive into the FHFA report, let’s touch on something that’s been making many North Shore Chicago homebuyers smile – those low mortgage rates. Seriously, have you seen them lately? It’s like a golden ticket for anyone thinking about making a move into homeownership. Low rates mean more buying power and potentially lower monthly payments. It’s like a little gift from the real estate universe!

Now, tie this in with the FHFA report. As the FHLB potentially takes on a more substantial role in affordable housing, there could be opportunities for homebuyers to leverage these low mortgage rates to make their dream home more affordable. Keep an eye on the market and mortgage trends – timing could be everything!

Homebuyer Help on the Horizon: Embracing or Challenging Change?

Now, let’s get to the nitty-gritty of the FHFA report. It’s suggesting some significant changes, like the reduction of the number of Home Loan banks and an 80% cut in executive compensation. Whoa, right? The banks are now faced with a choice – challenge the redefinition of their mission or roll with the punches and embrace it.

So, what does this mean for you, the North Shore Chicago homebuyer? Well, change can bring opportunities. If the FHLB embraces its new role in affordable housing goals, it could translate into more resources and support for homebuyers. Think of it as having a helping hand on your homeownership journey.

On the flip side, challenges to the redefinition might stir up some waves. It’s like watching a chess game unfold, and we’re all wondering how the pieces will move. As a savvy North Shore Chicago homebuyer, staying informed about these changes could be your secret weapon in navigating the market.

Quantifying the Taxpayer Subsidy: What’s the Deal?

Now, here’s a tricky bit – the FHFA report doesn’t exactly quantify the taxpayer subsidy for the banks. It’s like a missing puzzle piece, leaving us to wonder how much taxpayer money is in the mix. But here’s the interesting twist – the report suggests increasing the affordable housing assessment. This means there might be a push to allocate more funds toward making housing more affordable for folks like you, the North Shore Chicago homebuyer.

As you keep your eyes peeled for your dream home, this financial jigsaw puzzle might just play into your favor. The potential increase in affordable housing resources could open up new opportunities or programs designed to make your homeownership journey smoother.

Consolidation: Cost Savings and Future Possibilities

One major takeaway from the report is the possibility of consolidating banks. Now, I know the idea of banks merging might sound like corporate jargon, but stay with me. Consolidation could lead to significant cost savings. How does that impact you, the North Shore Chicago homebuyer? Well, if the FHLB manages to streamline its operations, it could mean more efficient and effective support for affordable housing initiatives.

Imagine those cost savings trickling down to programs or incentives designed to help you secure your dream home. It’s like finding extra money in your pocket that you didn’t know was there – always a pleasant surprise!

In Conclusion: Keeping a Watchful Eye as Changes Unfold

As a North Shore Chicago homebuyer, these changes in the FHLB landscape might seem like distant ripples. Still, they have the potential to create waves of opportunity for you. Stay tuned, keep an eye on those low mortgage rates, and remain informed about how the FHLB evolves. You never know – these changes might just pave the way for your smooth journey to homeownership in the beautiful North Shore Chicago area. Cheers to finding your dream home!

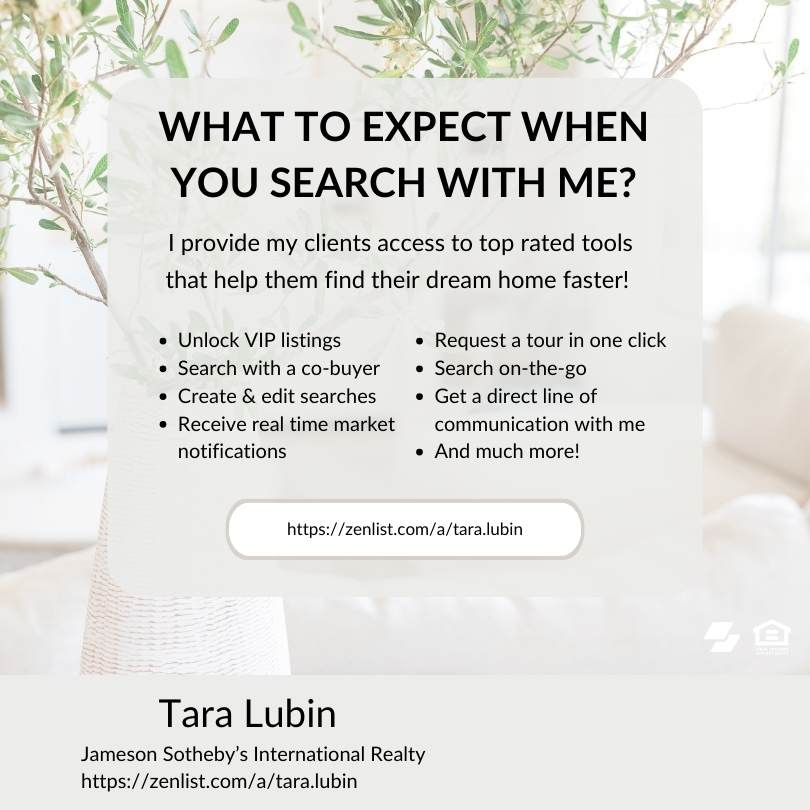

Call or contact me to if you have any Real Estate questions ~ I look forward to helping you. Tara Lubin | Jameson Sotheby’s International Realty REALTOR – Global Real Estate Advisor – Chicago & North Shore Suburban Chicago, Evanston, Wilmette, Winnetka, IL and beyond 630.707.3473 | [email protected] | [email protected]