Cook County Homeowners Rejoice: $30.5 Million in Automatic Property Tax Refunds Announced

In an unexpected turn of events, over 9,000 Cook County homeowners are set to receive a windfall of $30.5 million in automatic property tax refunds. The Cook County Treasurer’s office has announced this substantial reimbursement, which aims to provide financial relief to homeowners who may have overpaid their property taxes. What’s even more noteworthy is that these refunds will be distributed without the need for any applications or paperwork, making the process hassle-free for eligible recipients.

The Basics of Property Tax Refunds

Property tax refunds, though not a common occurrence, play a crucial role in rectifying overpayments and ensuring that homeowners are not burdened with excessive financial obligations. The $30.5 million initiative in Cook County is a testament to the government’s commitment to rectifying any discrepancies and providing financial support where due.

Overpayments in property taxes can occur for various reasons, including errors in assessment, miscalculations, or changes in property value that were not accurately reflected. The automatic refunds aim to rectify such discrepancies and ensure that homeowners receive fair treatment in their tax obligations.

Cook County’s Generosity

Cook County’s decision to allocate $30.5 million for property tax refunds showcases a commendable commitment to its residents. This initiative is not only a financial boost for eligible homeowners but also a reflection of the government’s dedication to transparent and equitable financial practices.

The county’s generosity is further underscored by the simplicity of the refund distribution process. By eliminating the need for applications or paperwork, Cook County ensures that eligible homeowners can access their refunds without unnecessary bureaucracy, streamlining the entire process for the benefit of the community.

Who Qualifies for the Refunds?

Understanding who qualifies for these automatic refunds is crucial for homeowners seeking financial relief. The eligibility criteria revolve around property tax exemptions, with a focus on specific categories such as Senior Citizens, Senior Freeze, and Disabled Persons.

Senior Citizens, those enrolled in the Senior Freeze program, and Disabled Persons are among the primary beneficiaries. These individuals often face unique financial challenges, and the property tax refunds aim to alleviate some of these burdens, providing much-needed relief for those who may be on fixed incomes or dealing with additional expenses due to disability.

To check eligibility, homeowners can visit the Cook County Treasurer’s website. The website will guide them through the process, offering a straightforward way to verify whether they qualify for a refund. This user-friendly approach ensures that eligible recipients can easily access the information they need without unnecessary hurdles.

According to the Cook County treasurer’s office, the breakdown of automatic refunds shows:

- About 1,900 homeowners who paid their property taxes online will see a total of $13.1 million electronically deposited to their bank accounts

- About 4,000 homeowners who paid their taxes through a bank/mortgage escrow account will be mailed refund checks totaling $8 million

- About 2,900 homeowners who paid taxes totaling $9.3 million in cash or by check will receive an electronic refund or will be mailed a refund application to ensure the proper party receives the refund.

Visit cookcountytreasurer.com to see if you have an automatic refund coming.

Last year, Pappas refunded Cook County property owners $47 million.

The Refund Distribution Process

One of the most appealing aspects of this initiative is the seamless process of distributing refunds. Qualified homeowners will receive 48% of the reimbursements directly into their bank accounts. This direct transfer ensures that the funds reach the intended recipients efficiently, allowing them to use the money for immediate financial needs or investments.

The Cook County Treasurer’s office has assured homeowners that the distribution process will be transparent and timely. By avoiding the need for applications or paperwork, the county aims to expedite the refund distribution, providing quick financial relief to those who qualify.

Impact on Homeowners

The $30.5 million in property tax refunds has the potential to significantly impact eligible homeowners. For those on fixed incomes, such as Senior Citizens or Disabled Persons, these refunds can offer a welcome financial boost, helping them cover essential expenses or invest in home improvements. The injection of funds into the local economy can also have positive ripple effects, stimulating economic activity within Cook County.

The impact extends beyond the immediate financial relief. It symbolizes a commitment to fairness and justice in taxation, demonstrating that the government is attentive to rectifying any errors and ensuring that homeowners are not burdened with unjustifiably high property tax bills.

Checking Eligibility

For homeowners eager to determine their eligibility for the automatic refunds, the Cook County Treasurer’s website is a valuable resource. A step-by-step guide on the website simplifies the process, making it easy for individuals to navigate and verify their eligibility status. Additionally, the website provides additional resources and information to assist homeowners in understanding the criteria for qualification.

As part of the eligibility-checking process, homeowners can review their property tax exemptions and assess whether they fall into the specified categories. This proactive approach empowers homeowners to take control of their financial situation, ensuring that those entitled to refunds can access them without delay.

Implications for the Real Estate Market

News of the $30.5 million in property tax refunds is likely to have implications for the real estate market in Chicago. Homeowners receiving these refunds may find themselves in a more favorable financial position, potentially influencing their decisions regarding property investments, renovations, or even selling their homes.

This injection of funds into the local economy can contribute to increased activity within the real estate market. Homeowners may be more inclined to undertake home improvement projects, enhancing property values and contributing to the overall aesthetic appeal of the community. Additionally, prospective buyers may view the market more favorably, knowing that homeowners have received substantial refunds, potentially making properties more attractive.

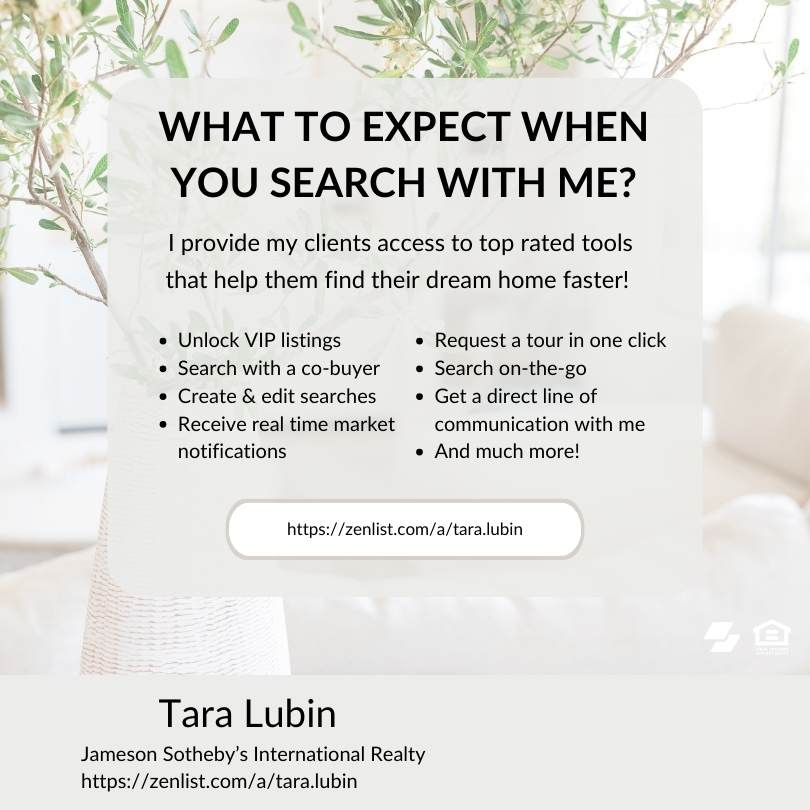

Call or contact me to if you have any Real Estate questions ~ I look forward to helping you. Tara Lubin | Jameson Sotheby’s International Realty REALTOR – Global Real Estate Advisor – Chicago & North Shore Suburban Chicago, Evanston, Wilmette, Winnetka, IL and beyond 630.707.3473 | [email protected] | [email protected]